The MetaTrader 4 trading system allows you to implement trading strategies of any complexity. By combining different types of market, pending and stop orders, as well as using a trailing stop, you can perform trades despite of the current market situation.

Three trade execution modes (instant, request and market) take flexibility to a new level. You can select the most appropriate mode for each trading situation.

If your trading strategy requires entering the market at a certain price, such action can be requested before performing a trade. As soon as the desired price appears, the trade can be performed.

However, if you want to enter the market at that specific time regardless of the price, select the market execution mode. In this case, the broker opens a position at the current market price without any additional confirmation from you.

Trading order types

An order is an instruction for a broker to perform a trade on your behalf. Depending on which conditions the trades are performed, there may be market, pending and stop orders:

- 3 execution modes

- 2 market orders

- 4 pending orders

- 2 stop orders

- Trailing stop

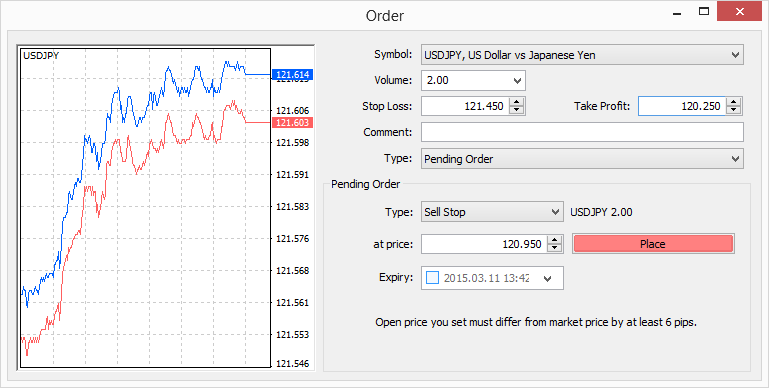

Market orders are used for instant execution. Pending orders are formed at the current moment but are to be performed in future, as soon as the market situation meets the specified conditions. For example, Buy Limit is an order to buy when the symbol price falls below the current one. You may use this order if you expect that after having reached a certain level, the downward trend will reverse and the price will roll back.

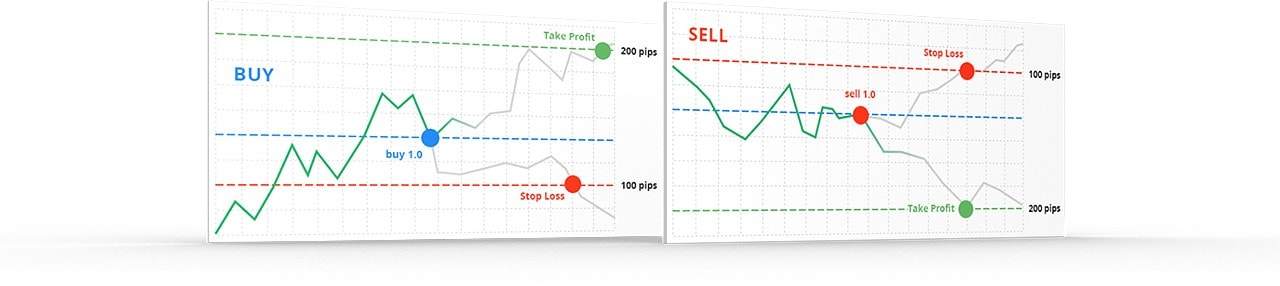

Stop orders (Take Profit and Stop Loss) help you to lock your obtained profits and minimize your losses. They are used in combination with market or pending orders, as well as with an already opened position.

For example, you can place a Buy Limit order and set the Take Profit level 200 points above the open price. Upon reaching the specified level, the long position is closed and the profit is fixed, so that you do not lose it if the price reverses and moves downwards.

Stop Loss works the same way and also closes the position. It is designed to minimize losses in case your forecast has turned out to be wrong. For example, a Stop Loss set 100 points below a long position automatically closes the position at that level in case the price moves down.

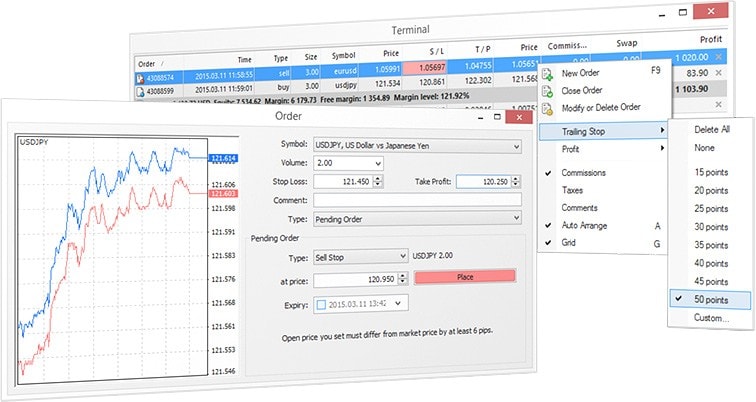

Trailing stop automatically moves Stop Loss along a fixed certain distance away from the current price in case the latter moves in a favorable direction. But if the asset price reverses, the Stop Loss stops moving, protecting your profit or minimizing losses.

Working with orders

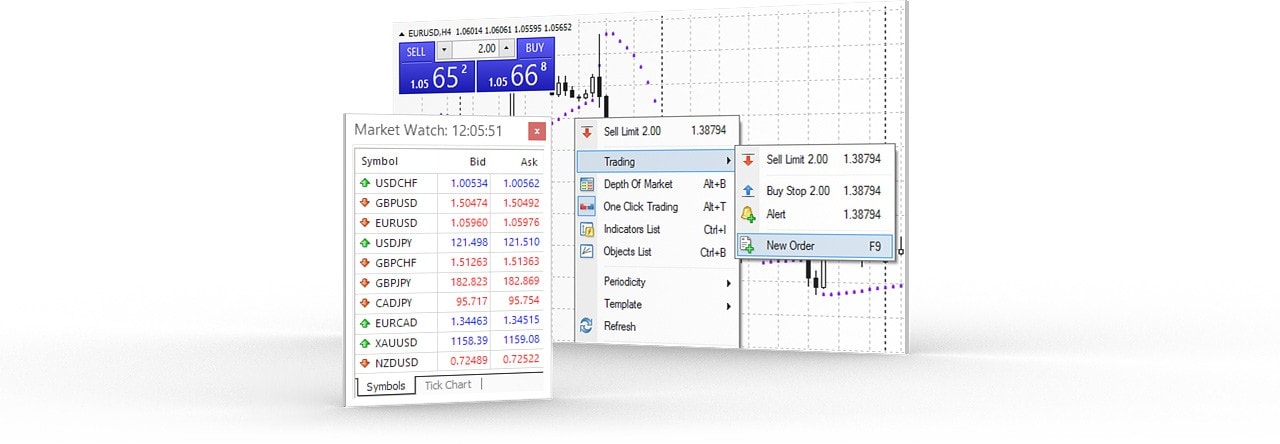

In MetaTrader 4, orders can be set in several ways – via the Market Watch, using the hotkeys or directly from the chart by enabling One Click Trading.

Comprehensive information about all orders and open positions are available in the Terminal – Trade window. From there you can track the number of orders and positions, open prices, volumes, stop orders and your account state. In addition from this window, you can review the detailed history of all your trades.

The powerful MetaTrader 4 trading system provides you with complete control over your trades and account. Choose MetaTrader 4, and you will have everything you need to be successful from favorable market conditions.